As Shop Auto Insurance Coverage Options: Complete Guide takes center stage, this opening passage beckons readers with casual formal language style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

The topic of auto insurance coverage is vast and complex, encompassing various options and factors that can significantly impact your coverage and costs. This guide aims to provide a comprehensive overview to help you navigate the intricate world of auto insurance with ease.

Understanding Auto Insurance Coverage

Auto insurance coverage is essential for protecting yourself, your vehicle, and others on the road. It provides financial protection in case of accidents, theft, or damage to your car. There are several types of auto insurance coverage options available, each serving a different purpose.

Types of Auto Insurance Coverage Options

- Comprehensive Coverage:This type of coverage protects your vehicle from non-collision incidents, such as theft, vandalism, or natural disasters.

- Collision Coverage:Collision coverage pays for repairs to your vehicle in case of a collision with another vehicle or object.

- Liability Coverage:Liability coverage helps cover costs if you are at fault in an accident that causes injuries or property damage to others.

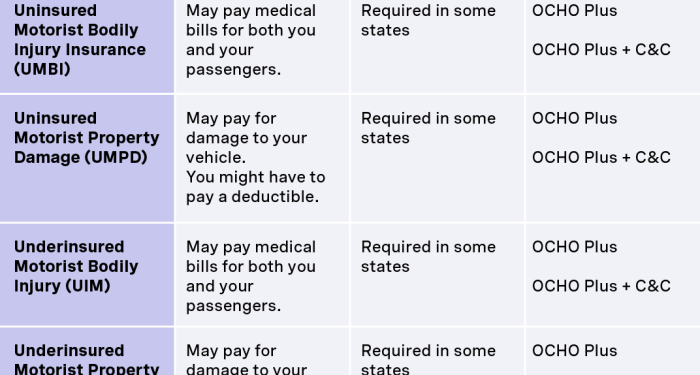

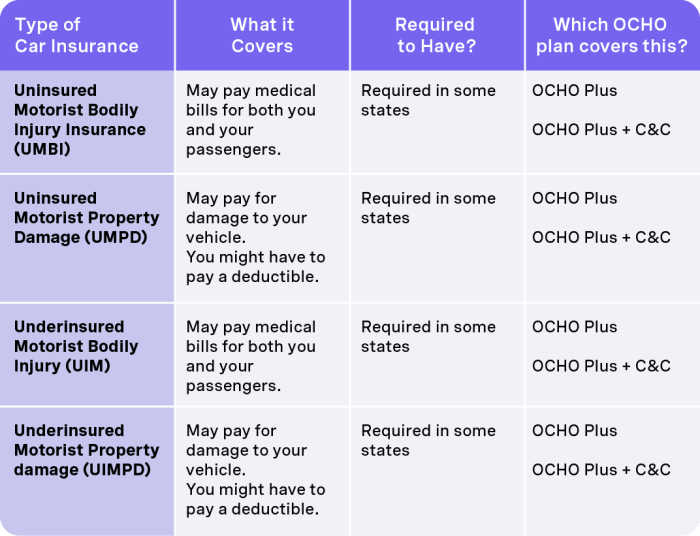

- Uninsured/Underinsured Motorist Coverage:This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient coverage.

Importance of Auto Insurance Coverage

Having auto insurance coverage is crucial for several reasons. It not only protects you financially in case of unexpected events but also ensures that you comply with state laws that require drivers to have a minimum level of coverage. Without insurance, you could face legal consequences and financial hardships in the event of an accident.

Comparison of Coverage Options

| Coverage Type | Protection Offered |

|---|---|

| Comprehensive | Covers non-collision incidents like theft and natural disasters. |

| Collision | Pays for repairs in case of a collision with another vehicle or object. |

| Liability | Covers costs if you are at fault in an accident causing injuries or property damage to others. |

| Uninsured/Underinsured Motorist | Protects you in accidents with uninsured or underinsured drivers. |

Factors Affecting Auto Insurance Rates

When it comes to determining auto insurance rates, there are several factors that insurance companies take into consideration. These factors can vary from personal driving history to the type of vehicle being insured. Understanding these factors can help individuals make informed decisions when selecting an auto insurance policy.

Personal Driving History and Location

- Insurance companies often look at an individual's driving record to assess the level of risk they pose. A history of accidents or traffic violations can result in higher insurance premiums.

- Moreover, the location where a driver resides can also impact insurance rates. Urban areas with high crime rates or heavy traffic tend to have higher premiums compared to rural areas.

- Drivers in regions prone to severe weather conditions or high rates of vehicle theft may also face increased insurance costs.

Type of Vehicle and Coverage Level

- The make, model, and age of the vehicle being insured play a significant role in determining insurance rates. Luxury cars or sports vehicles typically have higher premiums due to their higher repair costs.

- Additionally, the coverage level selected by the policyholder can affect insurance costs. Opting for comprehensive coverage with additional protections will result in higher premiums compared to basic liability coverage.

- Factors like the vehicle's safety features, mileage, and usage (personal or commercial) can also impact insurance rates.

Customizing Coverage to Fit Your Needs

When it comes to auto insurance, one size does not fit all. It's important to customize your coverage to meet your individual needs and circumstances. By tailoring your policy, you can ensure that you are adequately protected in case of an accident or other unexpected events.Adding optional coverage can provide additional protection and peace of mind.

For example, roadside assistance can be a lifesaver if your car breaks down on the side of the road. Rental car reimbursement can help cover the cost of a temporary vehicle while yours is being repaired. These optional coverages may come at an additional cost, but they can be well worth it in certain situations.Deductibles and coverage limits also play a crucial role in customizing your insurance policy.

A deductible is the amount you pay out of pocket before your insurance kicks in. Choosing a higher deductible can lower your premium, but it also means you'll have to pay more in case of a claim. Coverage limits determine the maximum amount your insurance will pay out for a covered claim.

By adjusting these limits, you can tailor your policy to suit your specific needs and budget.

Shopping for Auto Insurance

When it comes to shopping for auto insurance, there are several important steps to consider in order to find the best coverage for your needs. One of the key factors in this process is comparing quotes from different insurance companies.

By doing so, you can ensure that you are getting the best possible rate and coverage options available to you.

Comparing Quotes

- Request quotes from multiple insurance companies to compare rates and coverage options.

- Consider factors such as deductibles, coverage limits, and additional benefits offered by each policy.

- Look for discounts or special offers that may be available to you based on your driving record or other qualifying criteria.

Evaluating Coverage Options

- Assess your individual needs and priorities to determine the type and amount of coverage that is right for you.

- Consider factors such as your driving habits, the value of your vehicle, and your budget when selecting coverage options.

- Consult with insurance agents or representatives to clarify any questions or concerns you may have about specific policy details.

Final Thoughts

In conclusion, Shop Auto Insurance Coverage Options: Complete Guide offers a thorough exploration of the key aspects to consider when selecting auto insurance coverage. By customizing your coverage and understanding the factors that influence rates, you can make informed decisions that best suit your needs.

With this guide in hand, you are well-equipped to shop for auto insurance confidently and secure the coverage that provides optimal protection.

FAQ Guide

What are the basic types of auto insurance coverage options available?

The basic types include comprehensive, collision, liability, and other coverage options.

How can I customize auto insurance coverage to fit my needs?

You can customize coverage by selecting optional add-ons like roadside assistance or rental car reimbursement, adjusting deductibles, and choosing coverage limits that suit your requirements.

Why is it important to compare quotes from different insurance companies?

Comparing quotes helps you find the most competitive rates and coverage options that align with your needs and budget.