Delve into the world of car insurance quotes and discover the compelling reasons behind why annual comparisons are crucial. This guide promises to enlighten you with valuable insights and practical tips for ensuring optimal coverage and savings.

Explore how rates fluctuate, the impact of personal and external factors, and the benefits of thorough comparison shopping in this dynamic landscape of car insurance.

Why Should You Shop Car Insurance Quotes Every Year?

Reviewing your car insurance quotes annually is crucial to ensure you are getting the best coverage at the most competitive rates. Here's why:

Rate Fluctuations

Car insurance rates can fluctuate significantly from year to year due to various factors such as changes in your driving record, insurance company policies, and even your location. By shopping around and comparing quotes, you can potentially save hundreds of dollars by switching to a more affordable option.

Policy Updates

Insurance companies frequently update their policies and coverage options. By shopping for car insurance quotes annually, you can explore new coverage options that might better suit your needs or provide additional benefits at a similar or lower cost.

Discount Opportunities

Insurance companies often offer new discounts or promotions to attract customers. By shopping around each year, you can take advantage of these discounts and potentially reduce your overall premium without sacrificing coverage.

Factors Impacting Car Insurance Rates

When it comes to determining car insurance rates, there are various factors that can influence how much you pay for coverage. Understanding these factors is essential when shopping for car insurance to ensure you get the best possible rate.

Personal Factors vs. External Factors

Personal factors such as age, driving record, and credit score can have a significant impact on your car insurance premiums. Younger drivers or those with a history of accidents may face higher rates compared to older, more experienced drivers with clean records.

On the other hand, external factors like market trends, the type of vehicle you drive, and the area where you live can also affect insurance rates. Changes in the economy or advancements in technology may lead to fluctuations in premiums.

Significance of Understanding Factors

- Personal factors: Your age, driving record, and credit score play a crucial role in determining your car insurance rates. Being aware of how these factors impact your premiums can help you make informed decisions when shopping for coverage.

- External factors: Market trends and other external factors can also influence insurance rates. By staying informed about these trends, you can better understand why your rates may change and adjust your coverage accordingly.

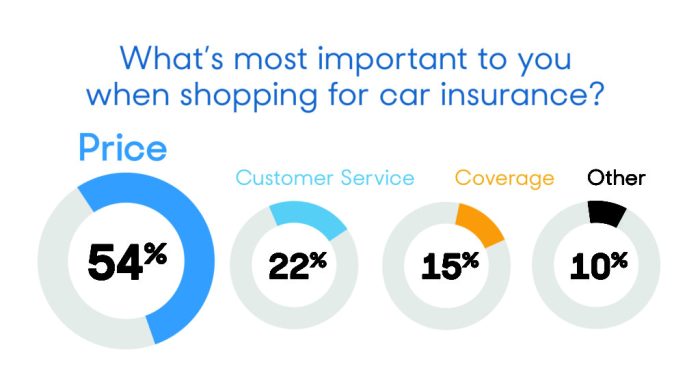

Benefits of Comparing Quotes from Multiple Providers

When it comes to shopping for car insurance, comparing quotes from multiple providers can offer numerous advantages. It allows you to explore different coverage options, find the best rates, and tailor your policy to suit your needs.

Advantages of Obtaining Quotes from Various Insurance Companies

- Access to a Wide Range of Options: By obtaining quotes from multiple providers, you can access a variety of coverage options and add-ons that may not be available with a single insurer.

- Potential Cost Savings: Comparing quotes allows you to find the most competitive rates in the market, helping you save money on your premiums without compromising on coverage.

- Customized Policies: Different insurers offer different policy features and benefits. By comparing quotes, you can customize your policy to include the coverage you need while eliminating unnecessary add-ons.

How Comparing Quotes Can Help in Finding the Best Coverage at Competitive Rates

- Identifying Coverage Gaps: By comparing quotes, you can identify any coverage gaps in your current policy and ensure that you have adequate protection in place.

- Negotiating Better Rates: Armed with multiple quotes, you can negotiate with your current insurer or other providers to secure better rates or discounts on your premiums.

- Gaining Insights into Insurance Market Trends: Comparing quotes regularly can help you stay informed about changing market trends, allowing you to make informed decisions about your coverage.

Tips on Effectively Comparing Different Insurance Offers

- Compare Apples to Apples: Ensure that you are comparing similar coverage levels and deductibles across different quotes to make an accurate assessment.

- Consider Customer Reviews: Look into customer reviews and ratings of insurance providers to gauge their service quality and reliability before making a decision.

- Utilize Online Comparison Tools: Take advantage of online comparison tools to quickly gather and compare quotes from multiple insurers in a convenient manner.

Changes in Personal Circumstances and Insurance Needs

Life changes, such as moving to a new location, getting married, or purchasing a new vehicle, can significantly impact your insurance needs. It is crucial to reassess your coverage requirements annually to ensure you have adequate protection in place.

Impact of Life Changes on Car Insurance

When you move to a new area, your insurance rates may change based on factors like crime rate, traffic density, and weather conditions. Getting married can lead to potential discounts on your car insurance policy. Additionally, buying a new car may require adjustments to your coverage to reflect the vehicle's value and features.

- When you move to a new area, your insurance rates may increase or decrease based on the location's risk factors.

- Marriage can result in lower premiums due to statistical evidence showing married individuals are involved in fewer accidents.

- Upgrading to a new vehicle may necessitate changes in coverage to protect your investment adequately.

Scenarios Requiring Updates to Car Insurance

There are several scenarios where updating your car insurance is necessary to ensure you are adequately protected.

- If you start using your vehicle for ridesharing services like Uber or Lyft, you may need additional coverage to protect you while working.

- Modifying your car with aftermarket parts or upgrades can impact your coverage limits and require adjustments to your policy.

- If you change jobs and have a longer or shorter commute, your mileage and usage patterns may necessitate changes to your policy.

Ending Remarks

In conclusion, the practice of shopping car insurance quotes annually emerges as a strategic approach to managing your coverage effectively. By staying informed and proactive, you can navigate the complexities of insurance with confidence and secure the best deals tailored to your evolving needs.

FAQ Corner

Why should I shop car insurance quotes every year?

Reviewing car insurance quotes annually ensures you stay informed about changing rates, find better coverage options, and potentially save money by exploring different providers.

What factors can impact car insurance rates?

Various factors like age, driving record, market trends, and personal circumstances can influence car insurance premiums. Understanding these factors is crucial when shopping for car insurance.

Why is comparing quotes from multiple providers beneficial?

Obtaining quotes from different insurance companies allows you to find the best coverage at competitive rates, offering more options and potential savings.

When should I reassess my car insurance coverage?

Reassessing coverage annually, especially after life changes like moving, marriage, or purchasing a new vehicle, is essential to ensure your insurance meets your evolving needs.