Embark on a journey through the world of shopping for auto insurance online with Shop Auto Insurance Online: Best Platforms Compared at the forefront. Get ready for a deep dive into the top platforms, key factors to consider, and tips for scoring the best deals.

Exploring the realm of online auto insurance shopping opens up a realm of possibilities and conveniences that traditional methods can't match.

Introduction to Shopping Auto Insurance Online

Shopping auto insurance online refers to the process of comparing and purchasing car insurance policies through digital platforms on the internet. This modern approach allows consumers to explore multiple options, customize coverage plans, and secure the best deals from the comfort of their homes.

There are several benefits associated with shopping for auto insurance online. Firstly, it provides convenience and flexibility, as customers can browse different policies at any time and place that suits them. Additionally, online platforms often offer lower premiums and discounts compared to traditional insurance agents, leading to potential cost savings for policyholders.

Trend of Online Auto Insurance Purchases

In recent years, there has been a significant increase in the number of consumers opting to purchase auto insurance online. According to industry reports, over 70% of car insurance shoppers now use digital channels to research, compare, and buy policies.

This trend is driven by the ease of access to information, transparency in pricing, and the ability to make informed decisions based on individual needs and preferences.

Comparison of Best Platforms for Shopping Auto Insurance

When it comes to shopping for auto insurance online, it's essential to know which platforms offer the best user experience and access to quotes from various insurance providers. Let's take a look at some of the top platforms and compare their key features.

Top Platforms for Shopping Auto Insurance Online

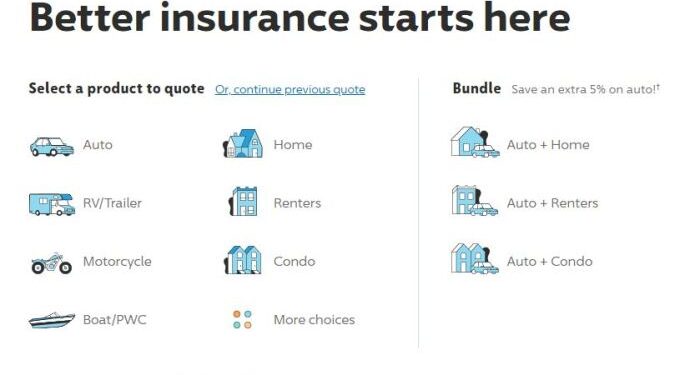

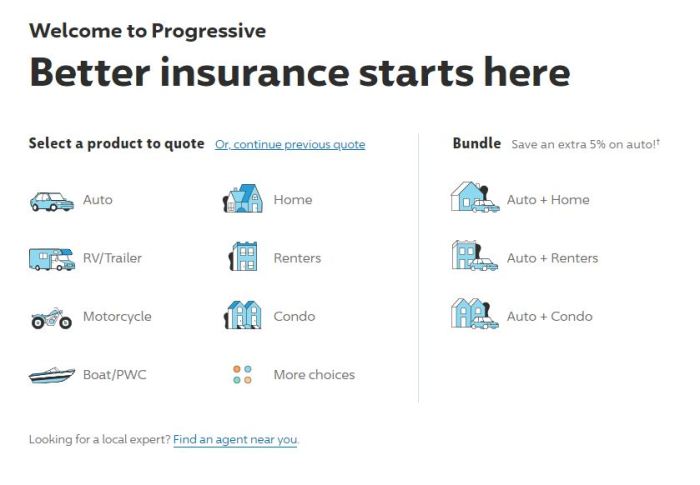

- Progressive:Progressive is known for its user-friendly interface, making it easy for users to input their information and receive quotes from multiple insurance companies quickly.

- GEICO:GEICO's online platform offers a simple and intuitive design, allowing users to easily navigate through the quote process and compare different coverage options.

- Esurance:Esurance provides a streamlined online quote process, with a clean interface that makes it easy for users to customize their coverage and see quotes from various insurers.

- Allstate:Allstate's online platform offers a comprehensive quote tool that allows users to input detailed information to receive accurate quotes from different insurance providers.

User Interface and Quote Availability

- Progressive:Progressive's platform is praised for its simplicity and speed in generating quotes from multiple insurers, providing users with a seamless experience.

- GEICO:GEICO's user interface is straightforward and easy to navigate, with clear steps for users to follow in obtaining quotes and comparing coverage options.

- Esurance:Esurance's online quote process is efficient and user-friendly, allowing customers to easily input their information and receive quotes from a variety of insurance companies.

- Allstate:Allstate's platform offers a detailed quote tool that ensures users receive accurate quotes based on the coverage options they select, making it easier to compare prices and policies.

Factors to Consider When Choosing an Online Auto Insurance Platform

When selecting an online auto insurance platform, there are several key factors to keep in mind to ensure you find the best coverage for your needs. From coverage options to pricing and customer support, each aspect plays a crucial role in determining the platform that suits you best.

Coverage Options

- Consider the types of coverage offered, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Look for additional options like roadside assistance, rental car reimbursement, and gap insurance.

- Ensure the platform provides customizable coverage to tailor a policy that meets your specific requirements.

Pricing and Customer Reviews

- Compare quotes from different platforms to find competitive pricing while maintaining adequate coverage.

- Read customer reviews and ratings to gauge the platform's reputation for customer service and claims handling.

- Consider the financial stability of the insurance company behind the platform to ensure they can fulfill claims when needed.

User Experience and Customer Support

- Evaluate the platform's website or app for ease of use, accessibility of information, and online account management features.

- Check the availability of customer support options, such as live chat, phone assistance, or email support for quick and efficient service.

- Look for online resources like FAQs, guides, and educational materials to help you understand your policy and coverage options.

Discounts and Special Offers

- Explore discounts for safe driving records, bundling multiple policies, being a loyal customer, or having certain safety features in your vehicle.

- Check for special offers like sign-up bonuses, referral rewards, or discounts for paying in full upfront.

- Ask about discounts for specific groups like students, military members, or seniors to maximize savings on your auto insurance policy.

Tips for Getting the Best Deal on Auto Insurance Online

When shopping for auto insurance online, it's essential to maximize savings and get the best deal possible. Here are some tips to help you achieve that:

Strategies for Comparing Quotes Effectively Across Platforms

- Get quotes from multiple platforms: To ensure you're getting the best deal, compare quotes from at least three different online insurance platforms.

- Provide accurate information: Make sure to input correct and updated information when requesting quotes to receive accurate pricing.

- Review coverage options: Look beyond just the price and compare the coverage options offered by each platform to find the best value for your needs.

How to Leverage Discounts and Incentives Offered by Online Platforms

- Check for discounts: Many online insurance platforms offer discounts for factors such as safe driving, bundling policies, or being a loyal customer.

- Utilize incentives: Some platforms may offer incentives like cashback or rewards for signing up or referring friends, so be sure to take advantage of these offers.

- Negotiate when possible: Don't hesitate to negotiate with the insurance provider if you believe you qualify for additional discounts or incentives.

Tips for Customizing Coverage Options Based on Individual Needs

- Assess your needs: Determine the coverage options that are essential for your situation, whether it's comprehensive coverage, liability, or additional perks like roadside assistance.

- Opt for higher deductibles: Choosing higher deductibles can lower your premium, but make sure you can afford the out-of-pocket costs if you need to make a claim.

- Consider usage-based insurance: If you're a safe driver, consider opting for usage-based insurance programs that offer discounts based on your driving habits.

Closure

In conclusion, navigating the landscape of online auto insurance platforms can lead to significant savings and tailored coverage options. Armed with the right information and tools, finding the perfect policy is just a few clicks away.

FAQ Compilation

What are some key factors to consider when choosing an online auto insurance platform?

Key factors include coverage options, pricing, and customer reviews. Additionally, user experience and customer support are crucial considerations.

How can I get the best deal on auto insurance online?

To secure the best deal, compare quotes across platforms effectively, leverage discounts and incentives, and customize coverage options to suit your needs.