Kicking off with What Is an Auto Insurance Quote and How Is It Calculated?, this opening paragraph is designed to captivate and engage the readers, providing a clear and informative overview of the topic.

Exploring the key components of auto insurance quotes and how they are calculated, this discussion aims to shed light on a crucial aspect of insurance policies.

What Is an Auto Insurance Quote?

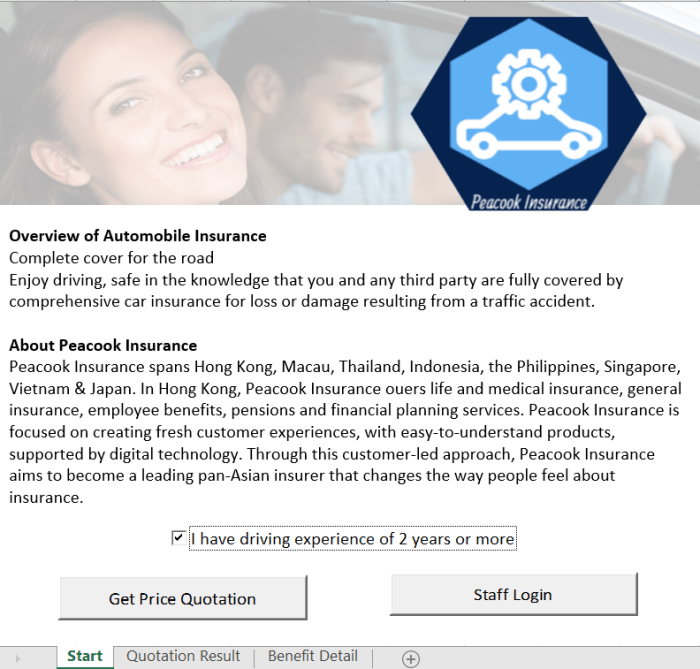

An auto insurance quote is an estimate of the cost of an insurance policy based on the information provided by the individual seeking coverage. It gives an idea of how much the insurance premium will be for a specific type of coverage.

Components of an Auto Insurance Quote

An auto insurance quote typically includes several components that help determine the final premium cost. These components often consist of:

- Basic information: This includes details such as the driver's age, gender, location, driving history, and the type of vehicle to be insured.

- Coverage options: Different types of coverage, such as liability, collision, comprehensive, and personal injury protection, will affect the overall cost of the policy.

- Deductibles: The amount the policyholder agrees to pay out of pocket before the insurance coverage kicks in can impact the premium.

- Discounts: Insurers may offer discounts for factors like bundling policies, having a clean driving record, or installing safety features in the vehicle.

- Additional fees: Some quotes may include administrative fees or charges for monthly payment plans.

Importance of Obtaining Auto Insurance Quotes

Obtaining auto insurance quotes before purchasing a policy is crucial for several reasons. It allows individuals to:

- Compare prices: Getting quotes from multiple insurance companies helps in finding the best rate for the desired coverage.

- Evaluate coverage options: By reviewing different quotes, individuals can see the range of coverage options available and choose the one that best suits their needs.

- Understand discounts: Comparing quotes also helps in identifying potential discounts that can lower the overall cost of the policy.

- Budget effectively: Knowing the estimated cost of insurance helps individuals budget and plan for this expense in advance.

How Is an Auto Insurance Quote Calculated?

When it comes to determining the cost of an auto insurance quote, insurance companies take into account a variety of factors to assess the level of risk associated with insuring a particular driver and vehicle. By understanding these key components, you can gain insight into how your premium is calculated.

Factors Considered by Insurance Companies:

- Driving Record: A clean driving record with no accidents or traffic violations typically results in lower insurance premiums, as it suggests a lower risk of future claims.

- Age and Gender: Younger drivers, especially teenage males, are often charged higher premiums due to statistical data showing they are more likely to be involved in accidents.

- Vehicle Type: The make and model of your car, as well as its age and safety features, can impact the cost of your insurance. More expensive or high-performance vehicles may result in higher premiums.

- Location: Where you live and park your car can also affect your insurance rate. Urban areas with higher rates of accidents or theft may lead to increased premiums.

- Coverage Limits: The amount of coverage you choose, such as liability, comprehensive, and collision coverage, will influence the overall cost of your insurance.

Variables Impacting Auto Insurance Quotes:

- Annual Mileage: The more you drive, the higher your risk of being involved in an accident, which can lead to higher premiums.

- Credit Score: In some states, insurance companies may consider your credit score when calculating your insurance rate, as it is believed to be correlated with the likelihood of filing a claim.

- Deductible Amount: Choosing a higher deductible can lower your premium, but it also means you'll have to pay more out of pocket in the event of a claim.

Role of Personal Information, Driving History, and Vehicle Details:

- Personal Information: Your age, marital status, and occupation may be factored into your insurance rate, as they can provide insights into your lifestyle and driving habits.

- Driving History: Past accidents, tickets, and claims will impact your insurance premium, with a history of safe driving leading to lower rates.

- Vehicle Details: The VIN number, mileage, and safety features of your car help insurers assess the risk of insuring your vehicle and determine the cost of your insurance.

Final Conclusion

In conclusion, understanding the ins and outs of auto insurance quotes and their calculation is essential for making informed decisions when it comes to your insurance needs. Take the time to compare quotes and consider all factors to ensure you get the coverage that suits you best.

Expert Answers

What factors can impact the cost of an auto insurance quote?

Factors such as age, driving record, type of vehicle, and coverage level can all influence the final cost of an auto insurance quote. Insurance companies take these variables into account when calculating your premium.

Why is it important to obtain auto insurance quotes before purchasing a policy?

Getting auto insurance quotes allows you to compare prices, coverage options, and discounts offered by different insurers. This helps you make an informed decision and choose the best policy for your needs.